Loading Data

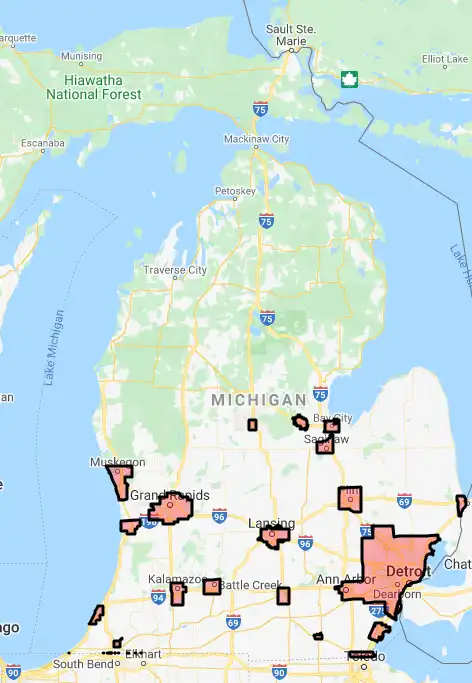

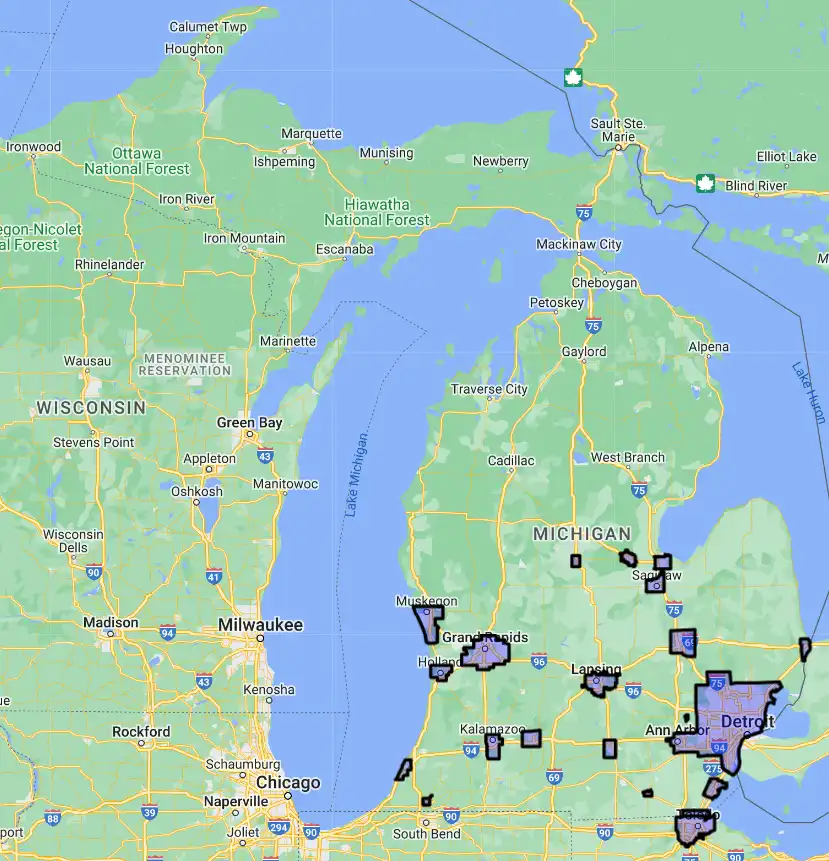

USDA Geographic Eligiblty Boundaries for Michigan

By area about 2.9% of Michigan is ineligible for rural development USDA home loans.

Regions of Michigan highlighed in red are not eligible for the USDA backed home loan programs. USDAProperties.com can help you determine exactly what properties are outside these boundaries. For higher resolution of the boundaries click the map to zoom in or search for specific postal (zip) codes, city names or even counties.

New 2024 USDA Loan Boundaries for Michigan

Use the search form to find your favorite counties, cities and zip codes in Michigan.

Benefits of Rural Life in Michigan

1. Quality of Life: Rural Michigan offers a peaceful, tranquil environment with plenty of recreational activities such as fishing, hunting, boating, camping, hiking, and biking. Residents enjoy the opportunity to take in the beauty of the state's many forests, lakes, and rivers.

2. Affordable Housing: There is a wide range of housing options in rural Michigan, ranging from large family homes to smaller, more affordable condos and apartments. Prices are generally lower than in urban areas and there are plenty of financing options available.

3. Low Crime: Rural Michigan is generally very safe and secure, with relatively low crime rates. This is a major draw for those who want to move away from the hustle and bustle of the city and enjoy a more peaceful way of life.

General Rural Housing Conditions in Michigan

1. Variety of Homes: Rural Michigan offers a range of housing options, from small cottages to large family homes. Many of these homes are older and require some work, but there are plenty of affordable and move-in ready options available.

2. Affordable: Home prices in rural Michigan are generally lower than in urban areas, making it easier for buyers to purchase a home without breaking the bank.

3. Financing Options: There are a variety of financing options available for those looking to buy a home in rural Michigan. These include government-backed programs such as FHA, VA, and USDA loans, as well as conventional mortgage loans from banks and private lenders.

Financing Options for Purchasing Homes in Rural Areas of Michigan

1. FHA Loans: FHA loans are backed by the Federal Housing Administration and are available to buyers with lower credit scores and down payments. These loans have lower interest rates and typically require lower down payments than conventional loans.

2. VA Loans: VA loans are available to veterans and active-duty military personnel and offer a number of benefits, such as no down payment and no mortgage insurance.

3. USDA Loans: USDA loans are government-backed loans specifically designed for rural areas. These loans offer a number of benefits, such as no down payment and low interest rates.

4. Conventional Loans: Conventional loans are available from banks and private lenders and typically require higher down payments and good credit scores.

Rural Living in Michigan

Direct Michigan USDA Program Administration Contact Information

USDA RD State OfficeFeatured Property from USDA Loan Eligible Regions of Michigan

3001 Coolidge Rd.

Suite 200

East Lansing, MI 48823

517-324-5190 | Fax 855-813-7741