Loading Data

Find USDA Eligible Properties in Tuscaloosa County

browse list of realtors working in Tuscaloosa County

browse list of realtors working in Tuscaloosa County

Tuscaloosa county has 1 usdaproperties.com realtor ready to help with your search!

| April Featured Agent | |

|---|---|

| Mattie Bell | from Century 21 Advantage |

Looking to buy in Tuscaloosa County, Alabama?

There are 1,329 USDA backed residential loans in Tuscaloosa county with an average loan balance of $142,587. Over 88% of the loans helped first time home buyers. Borrowers were an average age of 35 years old. The typical appraised home value was around $143,891. On average the rural home size purchased with this loan was approximately 1,572 SqFt. Tuscaloosa county applies the standard USDA income limits to determine loan eligibility. For a household of upto 4 people the income limit is $90,300. For a household of between 5 and 8 people the income limit is increased to $119,200.

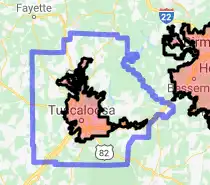

The size of Tuscaloosa County is roughly 3,504 square kilometers. USDA defined regions of rural loan ineligibility in Tuscaloosa cover 522 square kilometers of the county. Approximately 14.9% of Tuscaloosa County is ineligible for traditional USDA home loans. The influence score for Tuscaloosa County is 2. Look below for the interactive county level map illustration below for more details.

Select from the list of cities below or use the search feature to find active property listings in a city where you would like to live.

Start your search for USDA loan eligible properties in the cities of Tuscaloosa County, AL ![]()

* cities most likely to have USDA loan eligible properties for sale.

Abernant • *Brookwood • Bucksville • Buhl • Bull City • Burchfield • Cedar Cove • Chambers • *Coaling • *Coker • Cottondale • Docray • Dowdle • Dudley • Duncanville • Echola • Elrod • Englewood • Fleetwood • Fosters • Hagler • Holman • Holt • Howton • Kellerman • Kimbrell • *Lake View • Maxwell • Million Dollar Lake Estates • Moores Bridge • New Lexington • Northport • Pattersontown • Pearson • Peterson • Ralph • Rickey • Romulus • Samantha • Sandtown • Searles • Shirley • South Holt • Stokes • Taylorville • Three Forks • Tuscaloosa • *Vance • Whitson • Windham Springs • Yolande

A USDA loan is a mortgage option available to eligible homebuyers that is sponsored by the United States Department of Agriculture to promote homeownership in rural communities. USDA Loans, sometimes called "RD Loans," offer 100% financing options on eligible rural properties. USDAProperties can help you find USDA properties in Tuscaloosa County.

View the detailed USDA boundaries and read about general conditions of

Tuscaloosa County, Alabama

.

.Tuscaloosa County, located in the great state of Alabama, was formed on February 6, 1818, as one of the state's original counties. The county was created from territories acquired by the United States through the signing of the Treaty of Fort Jackson with the Creek Indians. Tuscaloosa is named after the Choctaw Indian Chief, Tuskaloosa, whose name in their language means "Black Warrior," which is also the name of the river running through the county.

In the early 19th century, Tuscaloosa County witnessed significant growth due to the development of cotton plantations and the arrival of new settlers as the Native American tribes were removed from the region. During the Civil War, the county faced economic strains as the demand for cotton decreased and many residents went to serve in the Confederate army.

Post-Civil War, the county experienced an economic boost with the establishment of the University of Alabama in Tuscaloosa in 1831, which became and continues to be a significant cultural, educational, and economic center for the region. The development of mineral resources also played a significant role in this county's growth.

A fun fact about Tuscaloosa County is that it was once the capital of Alabama. Between 1826 and 1846, Tuscaloosa served as the state capital until it was moved to Montgomery, which was deemed a more central location within the state.

Featured Cities of Alabama