Are You Looking to Buy Property With a Loan from the USDA?

Browse Property Listings:

Or

Information on new USDA loan eligibility boundaries and income requirements for 2024 have been implemented.

There are nearly one million USDA backed residential loans in the United States. Over 80% of these loans helped first time home buyers. Select from the list of states below or use the search feature to find available homes in your area. This site will help you determine if a USDA backed loan is a viable alternative to finance the home you are interested in.

A USDA loan is a mortgage option available to eligible homebuyers that is sponsored by the United States Department of Agriculture to promote homeownership in rural communities. USDA Loans, sometimes called "RD Loans," offer 100% financing options on eligible rural properties. USDAProperties.com can help you find Search for USDA Eligible Properties throughout the United States of America.

USDA loans are mortgages backed by the U.S. Department of Agriculture as part of its USDA Rural Development Guaranteed Housing Loan program. USDA loans are available to home buyers with low-to-average income for their area, offer 100% financing with reduced mortgage insurance premiums and feature below-market mortgage rates. Use the links and search forms above to find and see if a property can qualify. Then get advice from a local loan expert.

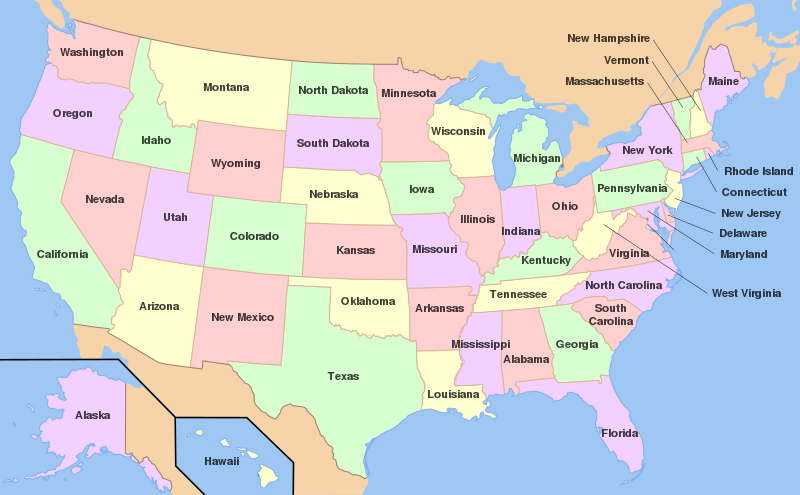

USDA loans have income limits that vary by region and are restricted to less developed areas of the United States. This image shows roughly what areas of the country are ineligible for a USDA loan. For high resolution geographic boundary displays continue into this site and look for maps at the state, county and even city and zip code level.

USDAProperties was designed to help you find suitable USDA eligible properties that meet your specific needs and connect you directly to local realtors who will help you make it happen.

Looking for a specific realtor to help you? Search for a realtor by name.