Loading Data

Find USDA Eligible Properties in Pitt County

browse list of realtors working in Pitt County

browse list of realtors working in Pitt County

Pitt county has 2 usdaproperties.com realtors ready to help with your search!

| July 2024 Featured Agents | |

|---|---|

| Lori Stancill | from Stancill Realty Group |

Looking to buy in Pitt County, North Carolina?

There are 1,080 USDA backed residential loans in Pitt county with an average loan balance of $128,392. Over 82% of the loans helped first time home buyers. Borrowers were an average age of 37 years old. The typical appraised home value was around $129,297. On average the rural home size purchased with this loan was approximately 1,526 SqFt. Pitt county applies the standard USDA income limits to determine loan eligibility. For a household of upto 4 people the income limit is $90,300. For a household of between 5 and 8 people the income limit is increased to $119,200.

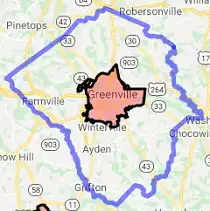

The size of Pitt County is roughly 1,694 square kilometers. USDA defined regions of rural loan ineligibility in Pitt cover 168 square kilometers of the county. Approximately 9.9% of Pitt County is ineligible for traditional USDA home loans. The influence score for Pitt County is 2. Look below for the interactive county level map illustration below for more details.

Select from the list of cities below or use the search feature to find active property listings in a city where you would like to live.

Start your search for USDA loan eligible properties in the cities of Pitt County, NC ![]()

* cities most likely to have USDA loan eligible properties for sale.

*Ayden • Ballards Crossroad • *Bell Arthur • *Belvoir • *Bethel • Black Jack • Boyd Crossroads • Bruce • Calico • Cannon Crossroads • Clayroot • Congleton • Coxville • Dupree Crossroads • Elmira Crossroads • *Falkland • *Farmville • *Fountain • Frog Level • Galloway Crossroads • Gardnerville • Greenville • *Grifton • *Grimesland • Haddocks Crossroads • Hams Crossroads • Hanrahan • Helens Crossroads • Hollands • House • Littlefield • Marlboro • New Belden • Oakley • Pactolus • Penny Hill • Quinerly • Reba • Redallia • Renston • Rock Spring • Rountree • Sharp Point • Shelmerdine • *Simpson • Staton • *Stokes • Stokestown • Venters • Washington Heights • Whichard • Whitehurst • *Winterville

A USDA loan is a mortgage option available to eligible homebuyers that is sponsored by the United States Department of Agriculture to promote homeownership in rural communities. USDA Loans, sometimes called "RD Loans," offer 100% financing options on eligible rural properties. USDAProperties can help you find USDA properties in Pitt County.

View the detailed USDA boundaries and read about general conditions of

Pitt County, North Carolina

.

.Pitt County, located in the great state of North Carolina, was established in 1760, carved out from Beaufort County. It was named in honor of William Pitt "The Elder," an influential British statesman and supporter of American colonial grievances during the time leading up to the American Revolution. The city of Greenville, which serves as the county seat, was founded in 1771 and was originally named Martinsborough, after the Royal Governor Josiah Martin, before changing its name in 1786 to Greenville in honor of the American Revolutionary War general, Nathanael Greene.

Situated in the eastern part of North Carolina, Pitt County is known for its rich agricultural history, with tobacco being a primary crop since the colonial era. In more recent years, it has gradually diversified its economy, with healthcare, education, and manufacturing now playing significant roles in the region.

A fun fact about Pitt County is the presence of East Carolina University, founded in 1907 as a teacher training school. It has now grown into a comprehensive public research institution, boasting strong programs in arts, sciences, and performing arts - including a renowned School of Music. In fact, the Greenville area is now known as a center for cultural and artistic events, thanks in large part to the university's contributions.

Featured Cities of North Carolina